Calculate Your Business Needs with Our Loan and Financing Tools

As a business owner, it is important to have the right tools in order to make financial decisions. Here at Simplifying Calculation, we offer several loan and financing calculators to help you calculate your business needs. Let’s take a look at some of our calculators and how they can benefit you.

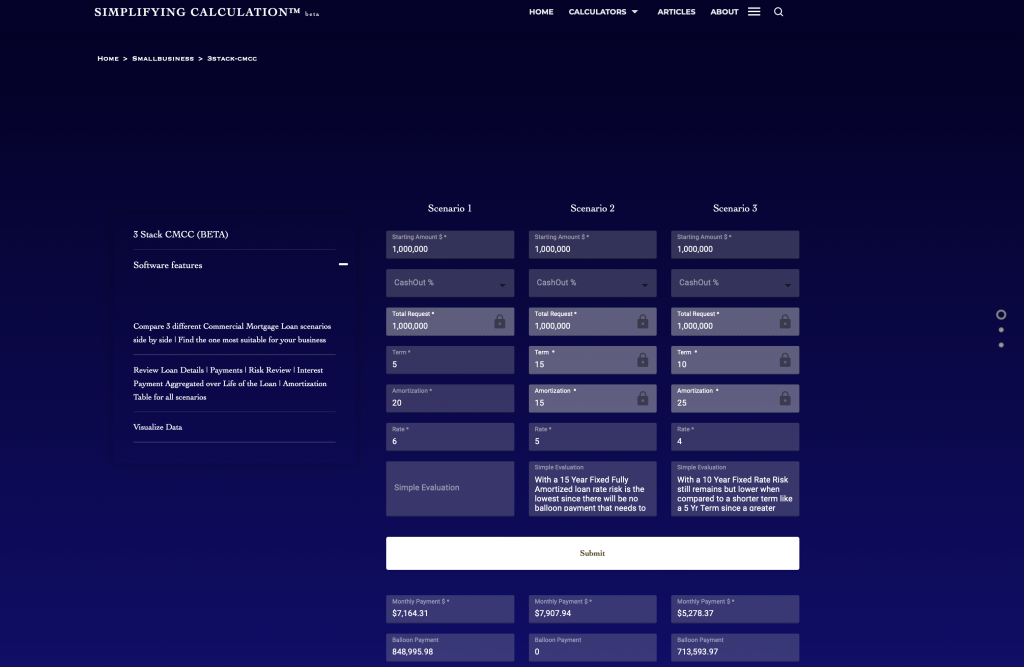

Commercial Mortgage Calculator

Our commercial real estate loan calculator is designed specifically for businesses looking to purchase or refinance commercial real estate properties such as office buildings or retail stores. This calculator will give an estimate on the total cost of acquiring a new property or refinancing an existing one by factoring in things like interest rate, down payment, closing costs, etc. It will also show estimated monthly payments so that businesses know exactly how much they are committing to each month when taking out a loan for commercial real estate purposes.

Invoice Financing Calculator

Our invoice financing calculator is designed to help small businesses manage their cash flow fluctuations by providing quick access to capital from unpaid invoices. This calculator allows you to see how much money you could receive for your unpaid invoices, as well as the fees associated with this type of financing. It also helps you decide whether invoice financing is the best option for your business or not.

Inventory Calculator

For businesses that need access to capital quickly, inventory financing may be the best option. Our inventory calculator makes it easy to calculate the amount of money you can borrow based on your current inventory levels. It will also determine the repayment terms and interest rate that apply to your loan request so that you know exactly what kind of deal you are getting.

Small Business Loan Calculator

A small business loan calculator helps businesses determine what kind of loan they need and how much they can get approved for. It takes into consideration factors like credit score, revenue, debt-to-income ratio, company size, industry, and more when calculating the maximum amount of money a business can qualify for. This calculator will also provide estimated repayment terms so that businesses know what kind of commitment they’re making before applying for a loan.

Equipment Loan Calculator

If your business needs equipment but doesn’t have the cash on hand right away, a business equipment loan may be necessary in order to purchase what’s needed upfront while paying back over time with fixed monthly payments and interest rates. Our business equipment loan calculator calculates factors like total cost of ownership (including taxes & fees), length of term (months), down payment requirements (if applicable), and more so that businesses know exactly what kind of commitment they’re making before taking out a loan for new equipment purchases or leases .

Calculating all aspects of loans & finance can be difficult without proper tools or knowledge – but it doesn’t have to be! At Simplifying Calculation, we offer several calculators that can help make financial decisions easier & less stressful for business owners everywhere. From invoice financing & inventory calculators all the way up through commercial real estate & equipment loans – our calculators are here to simplify the process & help make more informed decisions about finances than ever before! So don’t hesitate – check out our calculators today & get started on achieving success with confidence!